Custom Private Equity Asset Managers Things To Know Before You Get This

Wiki Article

Our Custom Private Equity Asset Managers Diaries

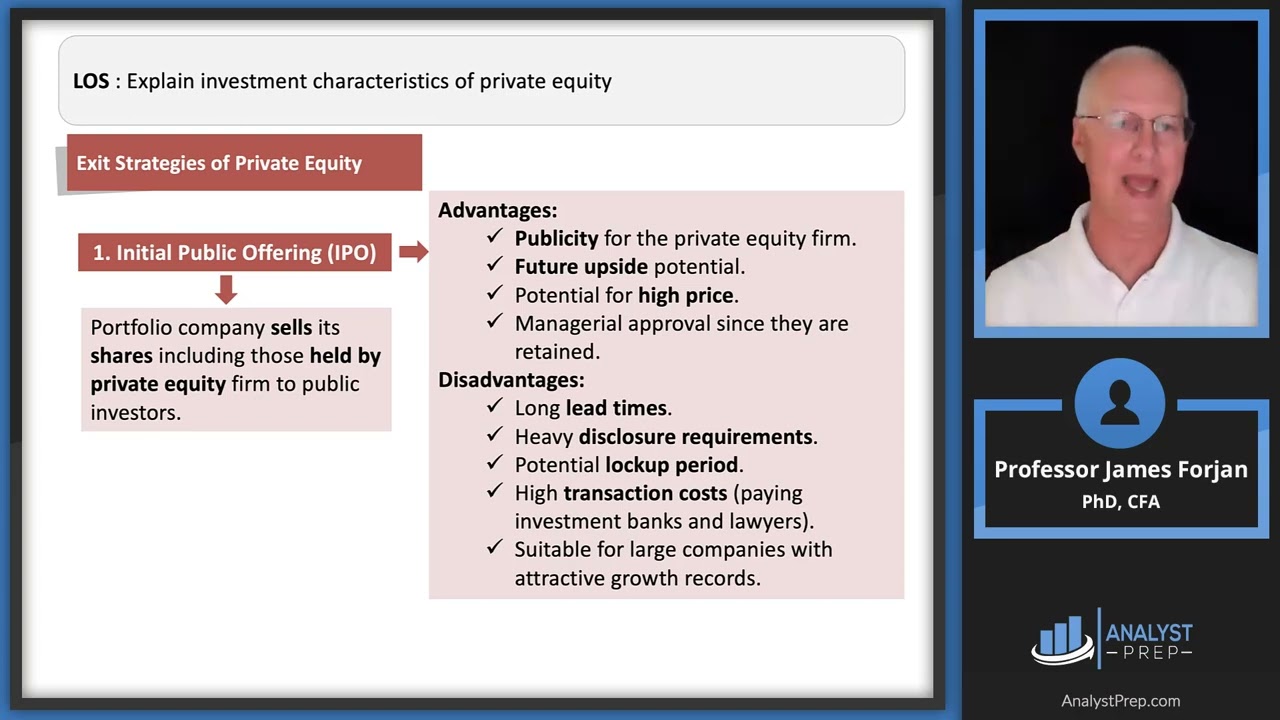

You've most likely come across the term personal equity (PE): spending in firms that are not openly traded. About $11. 7 trillion in possessions were taken care of by private markets in 2022. PE firms look for opportunities to make returns that are far better than what can be accomplished in public equity markets. There might be a few things you don't comprehend concerning the industry.

Exclusive equity companies have a range of financial investment preferences.

Due to the fact that the most effective gravitate toward the bigger offers, the center market is a substantially underserved market. There are a lot more sellers than there are extremely experienced and well-positioned money professionals with extensive customer networks and resources to handle an offer. The returns of personal equity are usually seen after a couple of years.

The Custom Private Equity Asset Managers Ideas

Flying listed below the radar of big international companies, numerous of these small companies often supply higher-quality customer care and/or niche items and services that are not being offered by the big corporations (https://myanimelist.net/profile/cpequityamtx). Such advantages draw in the rate of interest of personal equity firms, as they possess the understandings and smart to make use of such possibilities and take the business to the next level

Exclusive equity investors have to have trusted, capable, and reliable management in place. Most supervisors at portfolio firms are provided equity and reward settlement frameworks that reward them for striking their monetary targets. Such alignment of objectives is generally required prior to a deal obtains done. Private equity possibilities are commonly out of reach for individuals who can not invest numerous dollars, however they shouldn't be.

There are guidelines, such as limits on the aggregate quantity of cash and on the number of non-accredited financiers. The exclusive equity company brings in a few of the most effective and brightest in business America, consisting of top entertainers from Fortune 500 companies and elite administration consulting companies. Law companies can also be recruiting premises for personal equity works with, as accountancy and legal skills are try this out essential to complete offers, and transactions are very demanded. https://cpequityamtx.start.page.

Top Guidelines Of Custom Private Equity Asset Managers

An additional drawback is the lack of liquidity; once in a personal equity purchase, it is challenging to obtain out of or market. There is a lack of adaptability. Private equity likewise includes high costs. With funds under monitoring already in the trillions, private equity companies have actually become attractive investment lorries for well-off people and establishments.

Now that accessibility to exclusive equity is opening up to even more private investors, the untapped possibility is becoming a truth. We'll start with the main arguments for spending in personal equity: How and why personal equity returns have traditionally been greater than other properties on a number of degrees, Just how consisting of exclusive equity in a profile influences the risk-return profile, by helping to expand against market and intermittent threat, After that, we will certainly lay out some essential considerations and dangers for exclusive equity capitalists.

When it comes to presenting a brand-new possession into a profile, the most standard factor to consider is the risk-return profile of that possession. Historically, private equity has exhibited returns comparable to that of Emerging Market Equities and greater than all various other standard property classes. Its relatively low volatility coupled with its high returns makes for a compelling risk-return account.

Indicators on Custom Private Equity Asset Managers You Should Know

As a matter of fact, private equity fund quartiles have the best variety of returns across all different property classes - as you can see listed below. Methodology: Interior rate of return (IRR) spreads determined for funds within vintage years independently and afterwards averaged out. Average IRR was computed bytaking the standard of the mean IRR for funds within each vintage year.

The takeaway is that fund option is important. At Moonfare, we perform a rigid selection and due persistance procedure for all funds provided on the system. The result of including personal equity right into a portfolio is - as constantly - based on the profile itself. However, a Pantheon research study from 2015 recommended that including private equity in a portfolio of pure public equity can unlock 3.

On the other hand, the very best personal equity firms have access to an also bigger pool of unknown chances that do not deal with the same scrutiny, along with the resources to carry out due persistance on them and determine which are worth buying (Private Equity Platform Investment). Spending at the very beginning means greater danger, but also for the business that do be successful, the fund gain from higher returns

Our Custom Private Equity Asset Managers Ideas

Both public and exclusive equity fund supervisors dedicate to investing a portion of the fund but there continues to be a well-trodden problem with lining up interests for public equity fund administration: the 'principal-agent trouble'. When a capitalist (the 'principal') works with a public fund manager to take control of their resources (as an 'agent') they pass on control to the supervisor while retaining ownership of the possessions.

In the case of personal equity, the General Companion does not simply make a monitoring fee. Exclusive equity funds also alleviate an additional type of principal-agent problem.

A public equity capitalist ultimately desires something - for the management to raise the stock cost and/or pay out dividends. The investor has little to no control over the choice. We showed over the amount of private equity techniques - particularly bulk buyouts - take control of the operating of the company, guaranteeing that the long-lasting value of the business comes initially, rising the roi over the life of the fund.

Report this wiki page